2 moving average strategy | win rate: 63% +backtesting

In the fast-paced world of forex trading, the right strategy can be the difference between success and failure. Among the myriad of indicators available, the moving average stands out as one of the most reliable tools for traders. When two moving averages are combined, they create a potent trading strategy that can yield remarkable results. This article will introduce you to one of the simplest and most effective strategies in the trading world—a strategy that utilizes just two moving averages, the 60 EMA and the 240 EMA. This method is not only easy to implement but is also compatible with all major trading platforms, making it an ideal choice for both novice and experienced traders.

If you’re looking to enhance your trading approach with a straightforward yet powerful moving average trading strategy, you’re in the right place. We’ll guide you through the steps of using the 200 EMA and other moving averages in tandem, highlighting how this combination can be used for day trading or longer-term strategies. Stay with us as we explore this unique 2 EMA trading strategy and provide a detailed backtest analysis at the end of this article, so you can see firsthand the potential results of using this 200 day moving average strategy. Whether you’re new to the world of trading or a seasoned expert, this simple EMA crossover strategy could be the key to unlocking your trading potential.

Overview of the Moving Average Trading Strategy

When it comes to technical analysis in forex trading, the moving average is a cornerstone indicator that has stood the test of time. Its simplicity and effectiveness have made it a go-to tool for traders of all levels. At its core, the moving average smooths out price data to create a trend-following line, helping traders identify potential entry and exit points with greater accuracy. Whether you’re working with a single moving average strategy or a more complex system, the moving average remains a versatile and reliable component of any trading toolkit.

In this strategy, we focus on the powerful combination of two EMAs: the 60 EMA and the 240 EMA. The idea behind the EMA crossover strategy is simple yet effective—when the shorter-term moving average (60 EMA) crosses above the longer-term moving average (240 EMA), it signals a potential buying opportunity. Conversely, when the 60 EMA crosses below the 240 EMA, it may indicate a selling opportunity. This straightforward approach can be applied to various time frames, making it one of the best EMA strategies to use for day trading, as well as for longer-term trading horizons.

What makes this 2 EMA trading strategy particularly compelling is its adaptability and success rate across different market conditions. By using the 200 day moving average in conjunction with shorter-term EMAs, traders can gain a clearer view of market trends and make more informed decisions. Whether you’re trading on a 5-minute chart or a daily chart, this strategy offers a high level of precision and reliability. It’s a method that doesn’t just meet the needs of traders—it exceeds them, providing a robust framework for consistent trading success.

Tools Required for the 2 EMA Trading Strategy

One of the most appealing aspects of the 2 EMA trading strategy is its simplicity—no need for complex tools or fancy software. All you require are two essential indicators: the 60 EMA and the 240 EMA. By placing these two moving averages on your chart, you can unlock the full potential of this strategy without the clutter of unnecessary tools. This minimalist approach is what makes the strategy so popular among traders. The beauty of this method lies in its efficiency; the EMA crossover strategy provides clear, actionable signals that are easy to interpret. Below, we’ve provided these indicators for your convenience, so you can start applying the 200 EMA trading strategy immediately, whether you’re looking for the best EMA to use for day trading or for longer-term market analysis.

Best Settings for the Moving Average Indicator

Setting up the moving averages for the EMA crossover strategy is refreshingly straightforward. There’s no need for complicated adjustments—simply set both moving averages to the exponential mode, also known as EMA. Then, configure one indicator to a 60-period setting and the other to a 240-period setting. This combination of the 60 EMA and 240 EMA is at the heart of the 2 EMA trading strategy, offering a perfect balance between responsiveness and stability. Whether you’re looking to apply the best EMA to use for day trading or longer-term strategies, these settings provide the clarity and precision needed to make informed trading decisions. By using the 200 day moving average in this strategy, you’re not just following trends; you’re anticipating them, ensuring that you stay ahead in the fast-paced world of forex trading.

Optimal Time Frames for the 2 EMA Crossover Strategy

The beauty of the 2 EMA crossover strategy lies in its versatility—it works effectively across all time frames. However, given that this is a swing trading strategy, it tends to be most ideal on the 15-minute time frame. This shorter time frame allows traders to capitalize on quick market movements, making it perfect for those who prefer a more dynamic trading style. But if you find yourself short on time, don’t worry; this strategy is equally effective on higher time frames, such as the 4-hour and daily charts. Whether you’re using the 200 day moving average for longer-term analysis or focusing on shorter intervals with the best EMA for day trading, this strategy adapts seamlessly to your trading schedule and style, ensuring you can make the most of every market opportunity.

How the 2 EMA Trading Strategy Works

Now that we’ve covered the essentials, it’s time to dive into the mechanics of the 2 EMA trading strategy. The setup is incredibly straightforward, making it accessible even to those new to trading. Below, we’ve outlined the two primary ways to execute trades using this strategy: buying and selling.

Buying Setup

To initiate a buy trade, wait for a candle to cross the 60 EMA from below and close completely above it. This indicates a shift in momentum, signaling a potential upward movement. Once the candle fully clears the 60 EMA, enter a buy position. The take profit target is set at the 240 EMA, meaning the price should ideally move toward and touch this longer-term moving average. This method capitalizes on the phase shift indicated by the EMA crossover strategy, leveraging the momentum until it reaches the 240 EMA.

Selling Setup

For a sell trade, the process is essentially the reverse. Wait for candles to cross below the 60 EMA and close entirely beneath it. Once this happens, you can enter a sell position, anticipating that the price will continue to decline until it reaches the 240 EMA. This approach makes use of the EMA crossover strategy’s ability to detect bearish trends early, allowing you to ride the momentum down to your target.

Take Profit

The take profit for this strategy is straightforward—it’s the 240 EMA. Your trade remains active until the price hits this level, ensuring that you capture the full potential of the move.

Stop Loss

For stop loss management, you can incorporate the MACD indicator as an additional safeguard. If the MACD shifts phase in the opposite direction of your trade and at least two bars form in this new direction, it’s a strong signal to exit the trade. This method helps you avoid unnecessary losses and adds another layer of precision to the 2 EMA trading strategy.

By following these steps, you can effectively use the best EMA to use for day trading, applying the principles of the 200 EMA trading strategy to achieve consistent results. This strategy, with its simplicity and clear guidelines, offers a reliable way to navigate the complexities of the forex market.

Key Considerations for the EMA Crossover Trading Strategy

As you’ve likely noticed, the EMA crossover strategy is incredibly straightforward, making it an attractive option for traders of all experience levels. Its simplicity is part of what makes it so powerful—there’s no need for complex tools or in-depth analysis. Just two moving averages, a few essential rules, and you’re set to go. However, the ease of use shouldn’t lull you into complacency. To truly harness the potential of this strategy, there are critical aspects you must keep in mind.

Capital Management is Crucial

One of the most important elements in any trading strategy, including the 2 EMA trading strategy, is effective capital management. No matter how promising a setup looks, never risk more than what you can afford to lose. The allure of quick profits can sometimes push traders to take on too much risk, but discipline is key. By adhering to sound capital management principles, you ensure that a string of losses doesn’t wipe out your account, keeping you in the game for the long haul.

Stick to Your Exit Points:

The 2 EMA trading strategy thrives on its clarity—enter when conditions are met, and exit when the price reaches the 240 EMA. However, it’s essential to respect your exit points. Even if the trade looks like it might go further, it’s better to secure your profits according to plan. Emotional trading can lead to costly mistakes, so trust the process and follow the rules you’ve set. This approach ties into the broader concept of using the best EMA to use for day trading, which revolves around consistency and precision.

Beware of Multiple Touches:

Another critical factor to remember is the behavior of the price concerning the 240 EMA. If the price touches the 240 EMA once, it’s a solid signal that the move has likely completed. Attempting to trade the same setup again after the price has already hit the 240 EMA increases the risk of a reversal. The market tends to lose momentum after a significant move, so it’s wise not to chase a second opportunity in the same direction. Risking a trade under these circumstances could lead to unnecessary losses, undermining the effectiveness of your 200 EMA trading strategy.

Patience is a Virtue:

Finally, remember that patience is your ally in trading. This strategy may not deliver a trade signal every day, especially if you’re trading on higher timeframes. But that’s okay—the goal isn’t to trade frequently; it’s to trade smartly. The more you can wait for the ideal conditions, the higher your success rate will be. This patience will serve you well, whether you’re trading a 2 EMA trading strategy or any other method.

By keeping these considerations in mind, you can maximize the potential of the EMA crossover strategy, using it to navigate the forex market with confidence and discipline.

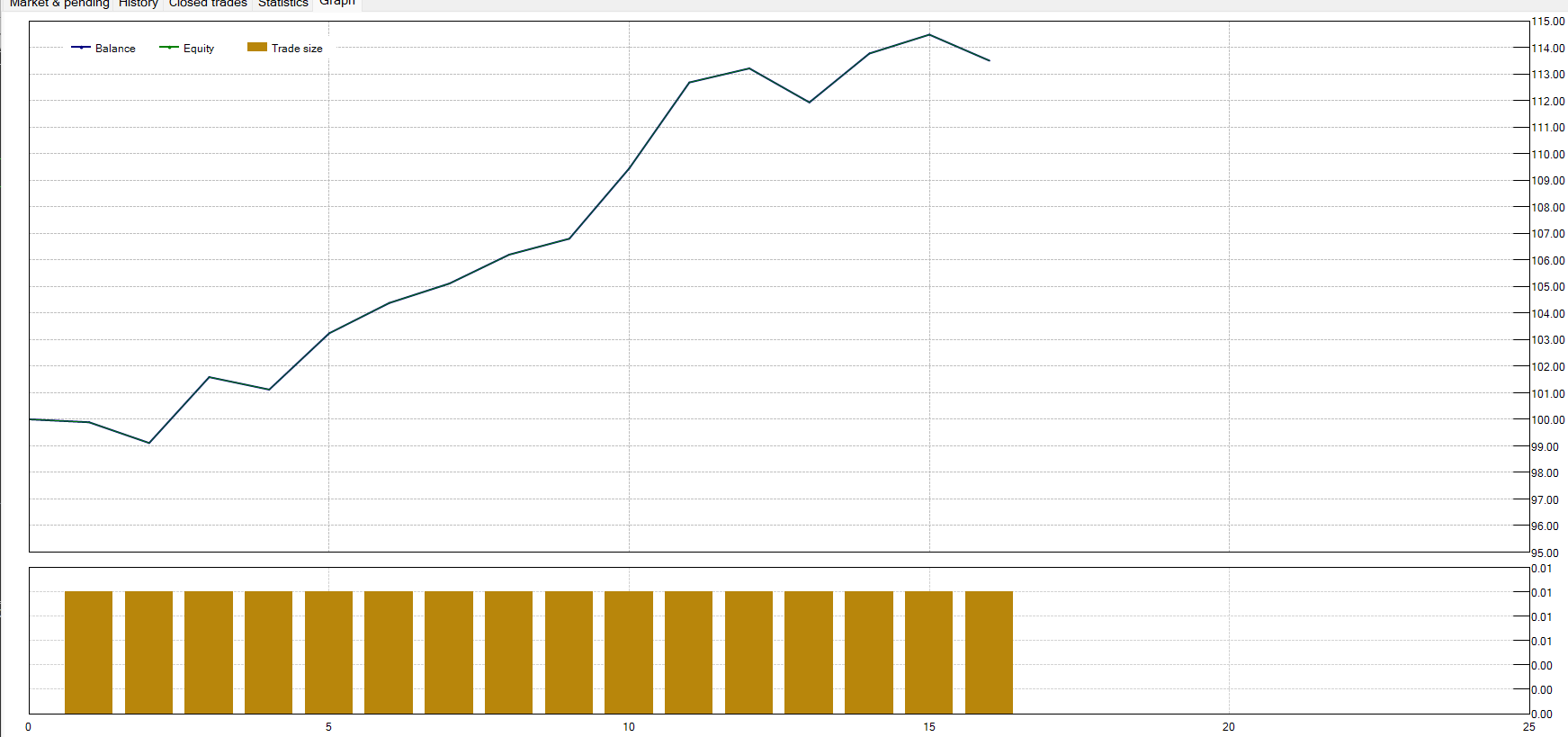

Backtesting Results of the 2 EMA Trading Strategy

When it comes to evaluating the effectiveness of any trading strategy, backtesting is an invaluable tool. It offers a glimpse into how a strategy might perform under real market conditions, providing traders with the data they need to make informed decisions. At PicoChart, we are committed to delivering profitable and reliable trading strategies. That’s why every strategy we share undergoes rigorous testing, including a thorough backtest, before it ever reaches your screen. We believe that transparency is key, and so we provide our users with detailed backtesting results to help guide their trading choices.

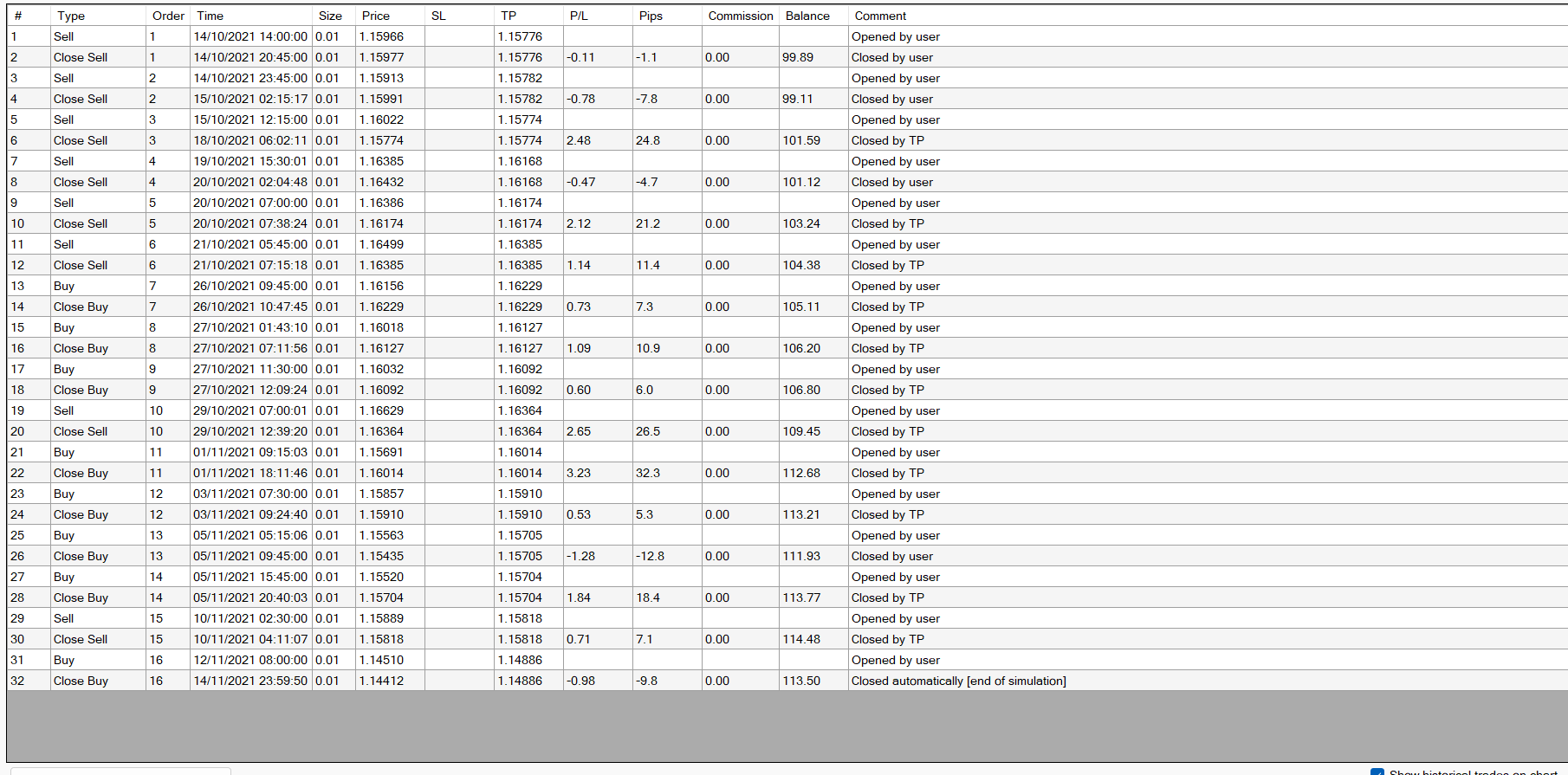

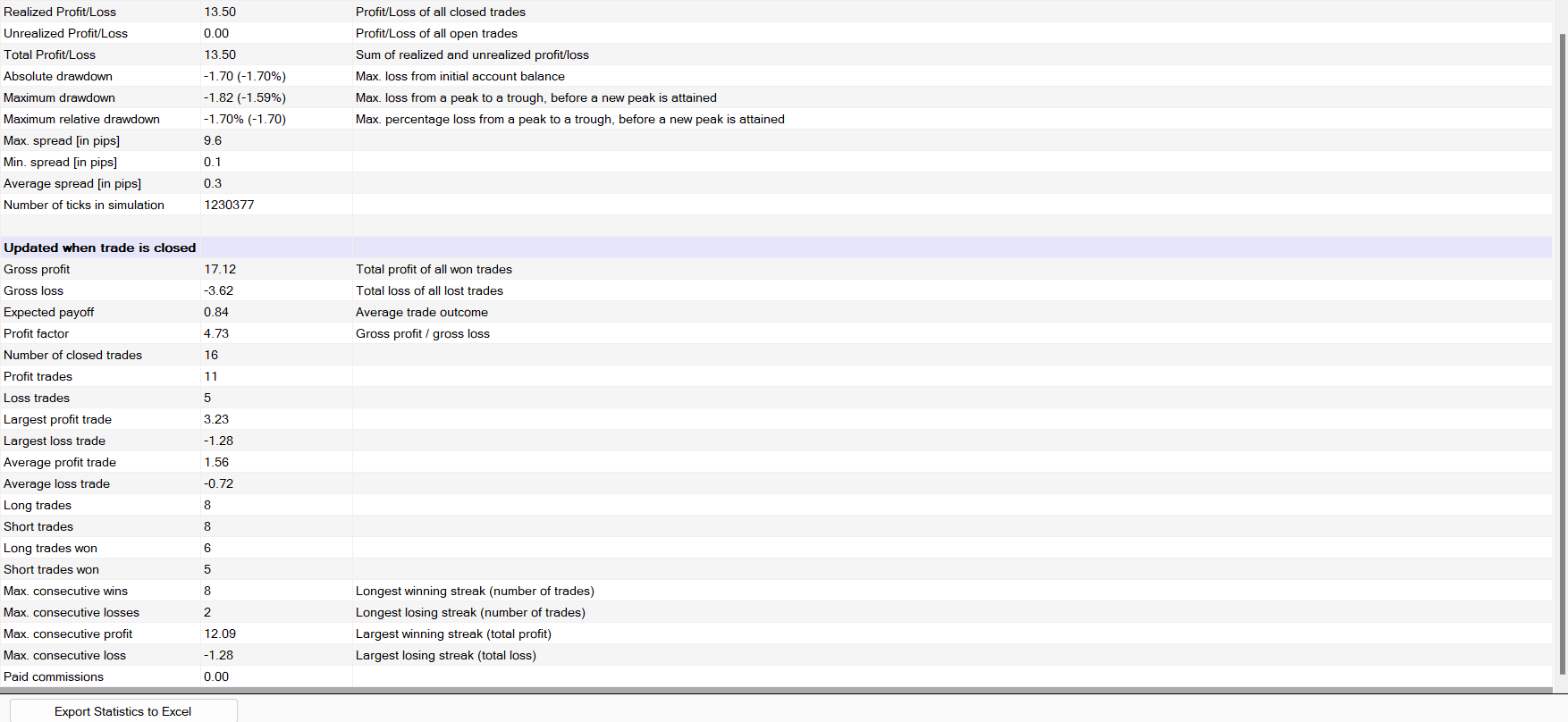

For the 2 EMA trading strategy using the 60 and 240-period exponential moving averages, we conducted a backtest on the EUR/USD currency pair over a one-month period, from October 14, 2021, to November 14, 2021. The test was carried out on a 15-minute timeframe, reflecting the strategy’s adaptability to shorter trading windows, which are often preferred by day traders.

The results were promising. Over the course of the month, we executed 16 trades using this strategy, of which 11 were profitable, and 5 resulted in losses. This translates to a win rate of 68.75%. Perhaps even more impressive is the return: despite trading on just one currency pair and within a single month, the strategy yielded a 13% profit. The average profit per winning trade was $1.56, while the average loss per losing trade was $0.72, giving a profit-to-loss ratio slightly above 2:1. This favorable ratio is one of the factors that contributed to the overall positive outcome.

It’s important to note that the backtest was conducted using a modest trading volume of 0.01 lots. Depending on your account size and risk tolerance, you can adjust this volume to potentially increase your returns. However, it’s crucial to maintain discipline and not overextend your capital, as even a well-tested strategy like this one carries inherent risks.

A Word of Caution:

While backtesting provides valuable insights, it is not a guarantee of future performance. Market conditions are constantly changing, and what worked in the past may not always work in the future. Therefore, we encourage you to do your own due diligence. Try out the strategy in a demo account first, perform additional backtests under different market conditions, and adjust it to suit your trading style. Remember, the responsibility for your trading decisions ultimately lies with you. PicoChart offers these insights as guidance, but we do not recommend or dissuade the use of any specific strategy. Always trade with caution and only invest what you can afford to lose.

maybe useful for you: